American National Renters Insurance Guide

Renting an apartment or house provides flexibility and freedom, but it also comes with its own set of risks. What happens if a fire damages your belongings? Or if a guest gets injured in your apartment? These are scenarios that can lead to significant financial burdens. That's where renters insurance comes in, offering a crucial safety net to protect your possessions and provide liability coverage.

Renters insurance is specifically designed for individuals who rent their homes. Unlike homeowners insurance, which covers the structure of the building, renters insurance focuses on protecting your personal property, providing financial assistance if covered perils damage your belongings, and offering liability protection if someone is injured on your property. It's a relatively inexpensive way to safeguard your finances and provide peace of mind.

This guide provides a comprehensive overview of American National Renters Insurance. We'll delve into the specifics of coverage, the benefits, the costs, and how to determine the right policy for your needs. Whether you're a seasoned renter or new to the rental market, this guide will equip you with the knowledge you need to make informed decisions about protecting your belongings and your financial well-being. Investing in American National Renters Insurance is an important step towards securing your peace of mind while renting.

Understanding the Basics of Renters Insurance

Renters insurance, also known as apartment insurance, is a type of insurance policy that protects your personal belongings in the event of a covered loss. It typically covers a range of perils, which are specific events or causes of damage. Common covered perils include fire, smoke, vandalism, theft, and certain types of water damage (e.g., from a burst pipe). It goes beyond just protecting your stuff, offering liability coverage and loss-of-use coverage.

What Does Renters Insurance Actually Cover?

Renters insurance typically includes three main types of coverage:

- Personal Property Coverage: This is the core of renters insurance. It covers your personal belongings, such as furniture, clothing, electronics, and other personal items, against covered perils. This coverage extends beyond your apartment, protecting your belongings even if they're stolen from your car or damaged while you're traveling.

- Liability Coverage: This protects you financially if you are legally responsible for an injury to someone else or damage to their property. For example, if a guest is injured in your apartment, your liability coverage can help cover their medical expenses or legal fees. It can also cover damage you accidentally cause to the building itself, like accidentally setting a fire.

- Loss of Use Coverage: If a covered peril makes your apartment uninhabitable, this coverage helps pay for temporary living expenses, such as hotel bills, food, and other necessary costs.

What Aren't Covered by a Standard Renters Insurance Policy?

While renters insurance offers broad protection, it doesn't cover everything. Common exclusions include:

- Damage to the building itself: The landlord is responsible for insuring the structure of the building.

- Acts of war or terrorism: These are usually excluded from standard policies.

- Certain natural disasters: Flood damage typically requires a separate flood insurance policy. Earthquakes may also have separate policies.

- Specific high-value items: Valuable items like jewelry, art, or collectibles may have limited coverage. You may need to purchase additional coverage or a rider for these items.

- Damage caused by your own negligence: Damage intentionally caused by the policyholder is not covered.

Benefits of Choosing American National Renters Insurance

American National Renters Insurance provides a solid foundation of protection for renters. Choosing the right policy offers a multitude of benefits, providing financial security and peace of mind.

Financial Protection for Your Belongings

The primary benefit is the financial protection for your personal property. Imagine the cost of replacing all your belongings after a fire or theft. Without renters insurance, you would have to bear those costs out-of-pocket. American National Renters Insurance can cover the cost of replacing your items, up to the limits of your policy, minus your deductible.

Liability Coverage for Unexpected Incidents

Liability coverage is another essential advantage. Accidents happen, and if someone is injured in your apartment or if you accidentally damage someone else's property, liability coverage can help protect you from costly lawsuits. It covers medical bills, legal fees, and other expenses associated with a covered incident.

Affordable and Customizable Policies

Renters insurance is generally affordable, especially when compared to the potential costs of replacing your belongings or facing a liability claim. American National Renters Insurance typically offers a range of policy options and coverage limits, allowing you to tailor the policy to your specific needs and budget.

How to Get the Right Coverage from American National

Determining the right amount of coverage is crucial to ensure you're adequately protected. Start by taking inventory of your belongings.

Conducting a Personal Property Inventory

Create a detailed list of your possessions. Include descriptions, estimated values, and any relevant receipts or photos. This inventory will help you determine the amount of coverage you need for your personal property. You can use a spreadsheet, a dedicated app, or a simple notebook. Don't forget to include items stored in your car, storage unit or other locations.

Choosing Your Coverage Limits

Once you have an inventory, estimate the total value of your belongings. This is the minimum amount of personal property coverage you should purchase. Consider also the liability coverage limits you need. Review your lease agreement for any specific requirements your landlord may have regarding liability coverage.

Understanding Deductibles

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible will typically lower your premium, but you'll have to pay more out-of-pocket if you file a claim. Consider your budget and how much you can comfortably afford to pay in the event of a loss.

The Cost of American National Renters Insurance

The cost of American National Renters Insurance varies depending on several factors.

Factors Affecting Your Premium

Several factors influence your premium, including:

- Coverage Limits: Higher coverage limits generally mean higher premiums.

- Deductible: A higher deductible will lower your premium, and vice versa.

- Location: The area where you live can impact your premium based on crime rates and other risk factors.

- Your Claims History: A history of filing claims may result in higher premiums.

- Discounts: Explore available discounts. Bundling your renters insurance with other policies, such as car insurance, can often result in cost savings.

Potential Discounts and Savings

Many insurance providers, including American National, offer discounts to help you save on your premiums. Common discounts include:

- Bundling Discounts: Combining your renters insurance with other policies, like auto insurance.

- Protective Device Discounts: Installing safety devices like smoke detectors and alarm systems.

- Loyalty Discounts: For being a long-time customer.

- Student Discounts: If you're a student and meet certain criteria.

- Payment Method Discounts: Enrolling in automatic payments.

Filing a Claim with American National

Knowing the claims process is essential.

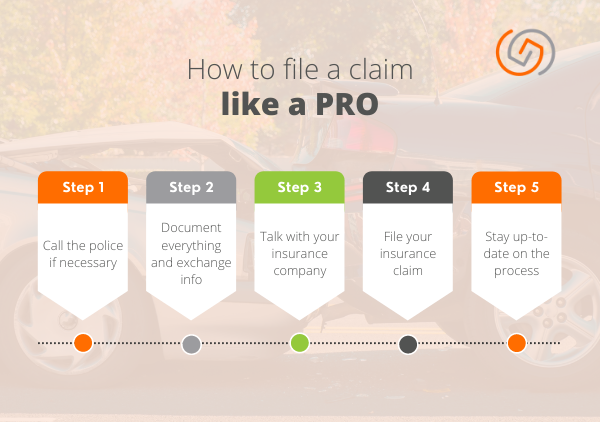

How to File a Claim

The steps involved in filing a claim typically include:

- Report the incident: Contact American National as soon as possible after a covered loss.

- Provide documentation: Gather evidence, such as photos, police reports, and your personal property inventory.

- Cooperate with the investigation: Work with the insurance company to provide any necessary information.

What to Expect During the Claims Process

American National will investigate your claim and assess the damage. They will determine if the loss is covered by your policy and calculate the amount of your reimbursement, minus your deductible. Understand the timeline for your claim and the communication methods used.

Comparing American National Renters Insurance to Other Providers

It's wise to compare quotes from multiple insurance providers to ensure you're getting the best value and coverage for your needs.

Researching and Comparing Policies

Obtain quotes from several different insurance companies, comparing their coverage options, policy limits, deductibles, and premiums. Read customer reviews to get a sense of the company's reputation for customer service and claims handling.

Evaluating Coverage Options

Carefully review the coverage details of each policy to ensure they meet your specific needs. Consider factors such as personal property coverage limits, liability coverage limits, and any specific exclusions.

Conclusion

American National Renters Insurance provides a valuable and affordable way to protect your personal belongings and finances while renting. This guide has covered the fundamentals of renters insurance, explaining what it covers, the benefits of having it, and how to select the right policy for your needs.

Choosing the right renters insurance policy is an essential step toward securing your peace of mind. By understanding the coverage options, evaluating your needs, and comparing different providers, you can make an informed decision that protects your belongings and safeguards you against unexpected financial burdens. Having renters insurance isn't just about protecting your stuff; it's about securing your future.